To say this year was abnormal would be an immense understatement. We have all been affected in different ways. Jobs lost, routines upended, schooling disrupted, jobs found, new routines established, plans changed (and changed again), new routines changed, lockdowns, loosened […]

The Payroll Tax Deferral is Ending – Are You Ready?

Millions of working Americans have had their payroll taxes deferred starting in September. This is going to end at the end of December (this month). The important thing for everyone is to recognize that this is a deferral, meaning you […]

Housing – Buy? Refinance? Hurry? Wait?

The housing market continues to be one of the strongest parts of the economy amid the COVID-19 pandemic. Housing supply is at historic lows. New building permits and housing starts are increasing. Home prices are increasing. If you’re in the […]

Make the Most of Your Christmas Presents

We have all received Christmas presents that we didn’t want or need. Why not make this the year to start getting meaningful gifts when the holidays and birthdays come around? Of all years, 2020 may be the year more people […]

Food for Thought

Two weeks ago, it was election day in the United States. Many of you were likely watching the results as they came in on election night and the days that followed. The high voter turnout shows how much more interest […]

Just Because You Can Afford Something Doesn’t Mean You Should – Part 3

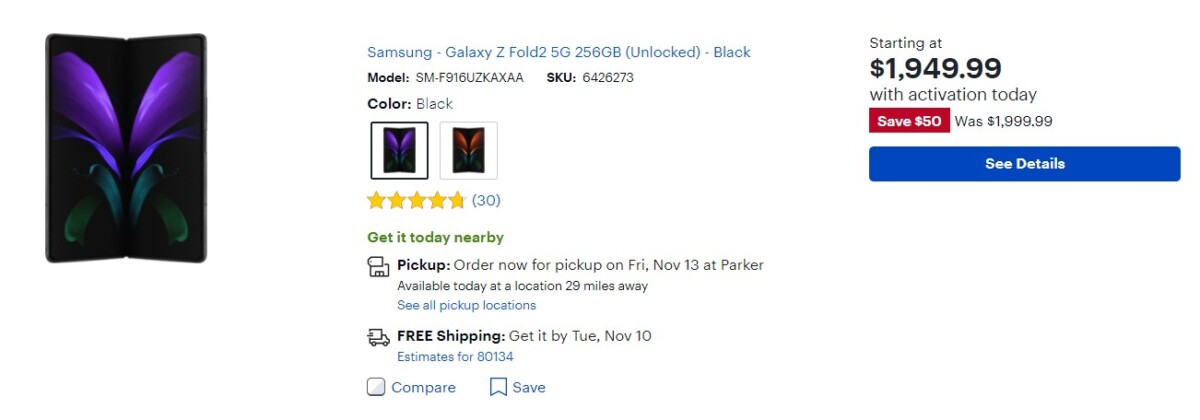

Continuing with the trade-off and affordability theme of the last couple weeks (click here for the housing example), today, I’ll cover trade-offs and affordability of electronic devices. Smartphones, tablets, laptops, televisions, Bluetooth speakers and headphones, and ‘Smart’ devices are becoming […]

Just Because You Can Afford Something Doesn’t Mean You Should – Part 2

In my last post, I wrote about considering trade-offs when making purchases. Today, I’ll start by digging into costs for most people’s largest expense, their primary residence. After costs, I’ll give an overview of what banks do when pre-approving you […]

Just Because You Can Afford Something Doesn’t Mean You Should – Part 1

When I started “Rat Race Off Ramp”, I highlighted a few ways to think about money, saving, and spending. Two of my early posts were “Money and Your Life” and “Spending with a Different Mindset.” In another post, “Are you […]

Why I don’t have a job

Well, let’s be completely clear. I am a stay-at-home dad (SAHD). That is my job, and it is more important than any job I could get paid to do. Even though I write with a goal of helping readers improve […]

Can one change in your retirement planning save you over $100,000?

What would you do with an extra $100,000 during retirement? What could you do? – Travel more – Pay for grandchildren to go to college – Buy a ‘Dream’ car – Give more to charity – Pay for a large […]