We have all received Christmas presents that we didn’t want or need. Why not make this the year to start getting meaningful gifts when the holidays and birthdays come around? Of all years, 2020 may be the year more people […]

Food for Thought

Two weeks ago, it was election day in the United States. Many of you were likely watching the results as they came in on election night and the days that followed. The high voter turnout shows how much more interest […]

Just Because You Can Afford Something Doesn’t Mean You Should – Part 3

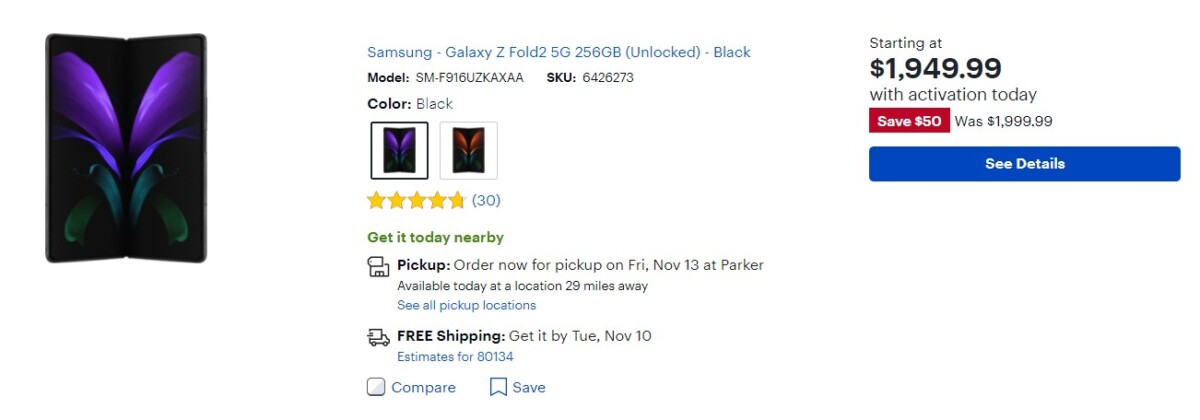

Continuing with the trade-off and affordability theme of the last couple weeks (click here for the housing example), today, I’ll cover trade-offs and affordability of electronic devices. Smartphones, tablets, laptops, televisions, Bluetooth speakers and headphones, and ‘Smart’ devices are becoming […]

Just Because You Can Afford Something Doesn’t Mean You Should – Part 2

In my last post, I wrote about considering trade-offs when making purchases. Today, I’ll start by digging into costs for most people’s largest expense, their primary residence. After costs, I’ll give an overview of what banks do when pre-approving you […]

Just Because You Can Afford Something Doesn’t Mean You Should – Part 1

When I started “Rat Race Off Ramp”, I highlighted a few ways to think about money, saving, and spending. Two of my early posts were “Money and Your Life” and “Spending with a Different Mindset.” In another post, “Are you […]

Can one change in your retirement planning save you over $100,000?

What would you do with an extra $100,000 during retirement? What could you do? – Travel more – Pay for grandchildren to go to college – Buy a ‘Dream’ car – Give more to charity – Pay for a large […]

What’s going on with the Social Security tax deferral?

On August 8, 2020, President Donald Trump issued a Memorandum to the Secretary of the Treasury with the subject of: Deferring Payroll Tax Obligations. This memorandum directed the Secretary of the Treasury to defer withholding Social Security payroll taxes from […]

Roth IRA – The Most Powerful Retirement Account

Traditional IRA, Roth IRA, Thrift Savings Plan (TSP), Roth TSP, 401(k), Roth 401(k), 403(b), and Roth 403(b) accounts are the main types of retirement accounts for those that are not self-employed. The different options can at times be confusing and […]

Do you have your priorities straight?

This sounds like a simple question, and it is, unless you dig deeper… There are two main areas in your life where you (and your loved ones) should always take precedence. No one else should have your health and the […]

What is a FICO Score and Why is it Important?

Applying for a loan. Applying for a credit card. Setting up utilities (electric, gas, water, etc.) for where you live. These are some of the events where a company uses your FICO score to help determine how risky a customer […]