We are all paying more for pretty much everything. If you want to buy a house, mortgage rates are up over 70% in the last six months, and the S&P 500, the primary metric for the ‘stock market’, recently entered […]

4 Easy Ways to Add Personal Finance to Your New Year’s Resolutions

Happy New Year! I hope you had a great 2021 and that 2022 is even better! Every year millions upon millions of people make New Year’s Resolutions usually with the goal of making changes to improve themselves and their lives, […]

What If…You Won the Lottery?

Sometimes the incredibly unlikely (or near impossible) happens, like winning the lottery. It is unlikely that anyone reading this will win a huge lottery jackpot, but bear with me. Hopefully, this short blog post can get you to really think […]

What If… You Become a Centenarian?

For the third post in the “What If” series (here are the first and second posts), I’m asking about becoming a centenarian. Do you know what a centenarian is? Don’t worry. I didn’t know exactly what the word meant until […]

What If…You Could Keep Your Kids From Repeating Your Money Mistakes

Although it is becoming more commonly taught, personal finance is a topic largely lacking in our public education system. That leaves the responsibility on families and kids themselves to either learn about personal finance or repeat the mistakes that millions […]

What is the Money Value of Your Time?

Today, I’m going to take a traditional phrase and flip it around. Many of you have likely heard the phrase “the time value of money” as it pertains to spending, saving, or money growing through compounding interest. By flipping the […]

How Much Does Psychology Affect Your Money?

Just recently, I finished reading The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel. It is easily one of the best books I’ve ever read about personal finance. It isn’t your typical ‘how to’ personal […]

Risks: Debt, Income, Housing & Inflation

Following up from my last post, I want to cover the potential risks that could affect everyone for the rest of 2021 and into 2022 regarding the economy and financial markets. Overall, the biggest risks fall into four areas: Debt, […]

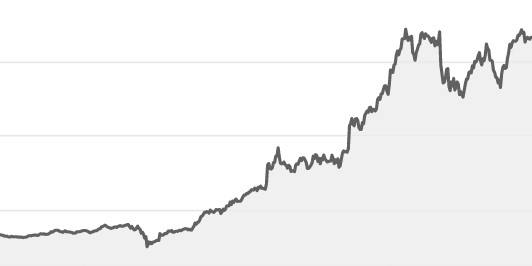

You Made Money in Stocks, Now What?

It is no secret that there has been a massive surge of retail investors buying stocks during the pandemic. Between ‘meme’ stocks, a ‘YOLO’ (You Only Live Once) / FOMO (Fear of Missing Out) environment, massive government spending, stimulus checks, […]

What’s Your ‘Why’?

In my last two posts, I went over the “Latte Factor” and excuses for not saving money. Maybe those posts got you thinking about your money. Those posts were a lead in for today’s post. There are many reasons why […]